Updating your browser will give you an optimal website experience. Learn more about our supported browsers.

Keeping Investment Costs Low

Our large fund size creates unique economies of scale that make our investment process more efficient. We never charge fees to our participating employers.

Understanding fees

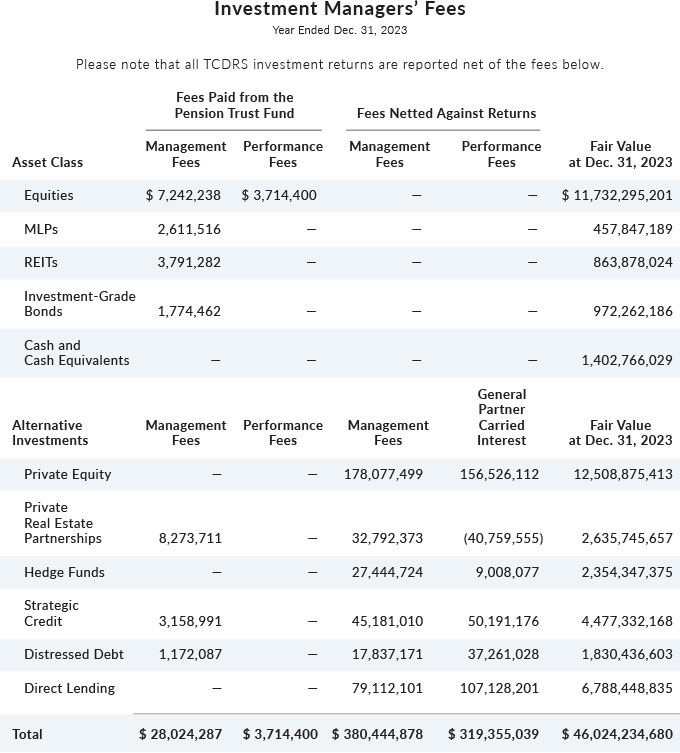

It’s worth mentioning that at TCDRS, we list all of our investment returns “net of fees”. This means we subtract all investment management fees before we list our returns. Because of this, the investment results you see on our website and our publications are the actual values available for TCDRS use.

Fees compensate investment managers for their time and expertise. For TCDRS, these fees are paid out of our investment earnings.

Investment management fees for our alternative investments, such as hedge funds and private equity, are higher than fees for more traditional investments, such as equities. There are also manager incentives associated with our alternative investments. These incentives align the investment manager’s interests with TCDRS’ interests. Put another way: When TCDRS makes money, the investment manager makes money. If TCDRS doesn’t make money, neither does the manager.

Alternative investment fees fall into two categories:

-

Management fees: These typically range from 1.5% to 2% of invested assets (hedge funds and opportunistic credit) or committed capital (private equity, private real estate, distressed debt and direct lending). They are intended to compensate the general partner for its costs in operating the partnership.

-

Profit sharing (also called “carried interest”): These fees incentivize and align the general partner’s interest with TCDRS’ interests. The carried interest represents the general partner’s share of the partnership’s profits, typically 20%, with 80% going to the limited partners such as TCDRS. Generally an agreed rate of return, or preferred return, must first be surpassed before carried interest is earned by the general partner. To incentivize general partners to maintain performance, periods of negative performance may result in previously accrued carried interest being reduced or “clawed back”.

Partnerships investing in private equity, private real estate, hedge funds, opportunistic credit, distressed debt and direct lending report results net of fees as permitted by FASB ASC 820. GASB 25 provides that plans such as TCDRS are not required to include in the reported amount of investment expenses those investment-related costs that are not readily separable from investment income (where income is reported net of related expenses). In the interest of greater transparency, management fees and carried interest associated with these types of investments are requested as part of TCDRS’ annual audit and are disclosed in the table above.

Related Content

Get more information on why TCDRS is a model plan when it comes to retirement.

Managing Investment Risk

Risk is a factor in any investment, and we manage risk very closely. Fortunately, we have a great track record of meeting our perform...

Read more

Responsible Guidance for Investments

The TCDRS Board of Trustees is responsible for overseeing the investment of TCDRS assets. They receive assistance from the investment...

Read more

04.02.2024

2024 TCDRS State of the System

Get an inside look at TCDRS' 2023 investment return and how it may impact your rate and annual plan decisions.

Read more