Updating your browser will give you an optimal website experience. Learn more about our supported browsers.

How to Estimate Your Retirement Benefit Online

Even if retirement feels like a long way off, you can still take steps today to ensure your financial forecast stays sunny — like running a benefit estimate in your TCDRS.org account.

One of the most exciting benefits of having a TCDRS.org account is the ability to run personalized benefit estimates to find out how much your monthly benefit payments might be in retirement.

Our Benefit Payment Estimator is an online tool that gives you the power to experiment with as many final dates of employment and retirement dates as you’d like, so you can see how timing affects your monthly benefit payment. The longer you work for your county or district employer, the higher your TCDRS monthly benefit payment will be.

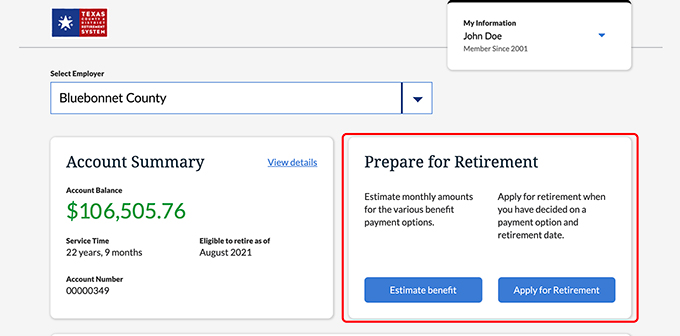

To run an estimate, first sign into your TCDRS.org account. If you don’t have a TCDRS.org account, you can learn more about how to register here.

Next, scroll down to the middle of your account summary dashboard page and click the blue “Estimate benefit” button in the “Plan for Retirement” box.

Enter the last day you plan to work. The tool will automatically populate your first-possible eligibility date if you worked for your TCDRS employer right up until your retirement, but you can move this to a date further in the future. This is the date deposits would stop being made to your account.

Click “Next” when you’re ready to proceed.

Next, enter your retirement date — the day you want to close your account and start receiving benefit payments. This date can be different from your last day of work.

For example, you might choose to stop working for your current TCDRS employer in 2022 but choose to leave your account open for several more years before applying to start receiving benefits. This would allow your account to continue growing with compound interest, even though deposits from your paychecks had stopped. (Learn more about how your benefits work here.)

Click “Next” when you’ve chosen your retirement date.

Now, you will need to select the beneficiary. This is the person who would receive your money if you pass away.

The Benefit Estimator tool automatically displays your current beneficiary, but you may choose to click the “+ Add beneficiary for estimate” link to add someone new for the purposes of your estimate, if you would like to see how that affects your benefit payment options.

Once you have selected your beneficiary, click “Get Estimate.”

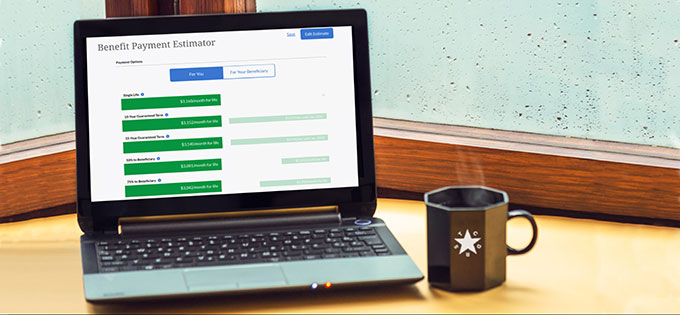

On this screen, you will see the benefit payment options you are eligible to receive, along with the estimated amounts you would receive per month under each option.

You can alternate between seeing the amounts you would receive and the amount that your beneficiary would receive under each payment option if you passed away by clicking the “For You” / “For Your Beneficiary” toggle buttons above the green bars.

If you would like to make changes to the information used to calculate your estimate, you don’t have to start all over. Instead, you can click the blue “Edit Estimate” button in the top right of the benefit payment options screen or scroll down to the bottom of the page to the “Estimate Settings” area.

Here, you can also add your salary information and yearly raise expectations, as well as a lump-sum amount you may consider taking when you retire (if your employer allows lump-sums).

This is also where you can find your projected account balance and see how much of your benefit payment would be funded by employer matching under these exact conditions.

Click the blue “Update Estimate” button in the lower right when you’re finished making adjustments to see your new payment amounts.

If you would like to save a PDF of your estimate, click the blue “Save” link in the upper right corner of the benefit payment option chart.

In the pop-up window, name the document and click “Save” again to download your PDF. You can generate as many PDFs as you like with different settings.

You can learn more about TCDRS’ benefit payment options here or by watching our video.

Related Content

Get more information on why TCDRS is a model plan when it comes to retirement.

Online Counseling for TCDRS Members

Online counseling is having a face-to-face counseling session with a TCDRS representative from the privacy of your home or office. A...

Read more

08.09.2021

TCDRS.org — Your Retirement Compass

The secret to enjoying a smooth retirement adventure.

Read more

07.15.2022

Market Volatility and Your TCDRS Account

Your TCDRS account is designed for stability. It will continue to grow regardless of the ups-and-downs of the market.

Read more