Updating your browser will give you an optimal website experience. Learn more about our supported browsers.

Helping Texans Move

Toward Retirement

Find out more about the Texas County & District Retirement System, including leadership, governance, legislation and more.

Who We Are

We Do Retirement Right

For more than 50 years, TCDRS has been a model for providing reliable retirement benefits. Benefits are responsibly funded, which means costs are not pushed to future generations.

As of Dec. 31, 2024, we had $51 billion in net plan assets, and a funded ratio of 90%. If you consider the reserves, TCDRS is 97% funded.

Savings Based

Members save for their own retirement over the length of their careers. The TCDRS benefit is based on the total final savings balance and employer matching.

Responsibly Funded

Our employers pay 100% of their required contribution rate each year. This ensures that funds are there when needed.

Flexibility & Local Control

TCDRS is not a one-size-fits-all system. TCDRS employers can choose benefit levels to meet their needs and budgets.

Leadership

Driving Us Forward

The TCDRS executive team is responsible for fulfilling the board of trustees’ vision for the retirement system. With the guidance and initiative of our leadership team, TCDRS is able to provide outstanding services to our participating employers, members and retirees.

Governance

Excellence in Governance

TCDRS was created by the Texas Legislature in 1967 to provide Texas county and district employees with retirement, disability and survivor benefits. Get to know our board of trustees, meeting dates and how to submit an open records request.

Legislation

At the Capitol

Discover all the ways Texas state legislation could directly or potentially impact TCDRS, read Pension Review Board documentation and explore external links that contain useful legislation information.

Careers

Join Our Team

When you work for us, an outstanding retirement plan is just the beginning. We also offer excellent health benefits, competitive salaries, refreshing work-life balance and a collaborative environment.

media inquiries

Please direct requests for information about TCDRS to: Hahn Public Communications

Who we serve

Serving the Texans Who

Serve Texas

At TCDRS, we serve the people who serve the counties and districts — the employees, retirees and employers that define the unique character of the Lone Star State.

County & District Employers

TCDRS serves 891 Texas counties and diverse districts, like water districts, hospital districts, appraisal districts, emergency services districts and more. We help our employers compete with the private sector by providing competitive retirement benefits at affordable rates.

TCDRS works with:

891

county & district employers

Members & Retirees

Our members are nurses, mechanics, road crew workers, sheriffs, attorneys, office workers, jailers and judges, but they all have one thing in common: Their jobs make our communities better, providing valuable services, such as healthcare, education, utilities and public safety.

We provide benefits to:

More than 394K

Texans, including 88K+ retirees

our value

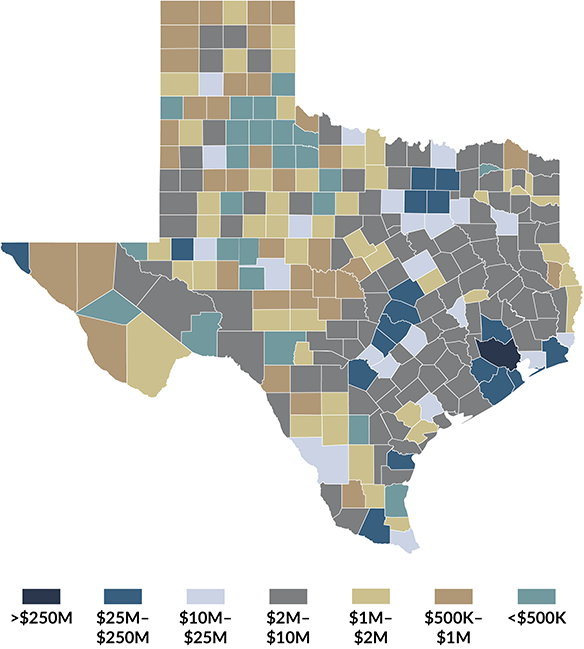

Billions In Benefits

In 2024, TCDRS paid $2.4 billion in benefits to retirees and former members, and 95% of that went to Texas addresses. Those benefit payments supported approximately:

- $3.6 billion in total economic activity

- 23,880 jobs created

- $1.0 billion in additional earnings

- $2.1 billion added to the Texas gross domestic product