Updating your browser will give you an optimal website experience. Learn more about our supported browsers.

Inflation and Cost-of-Living Increases

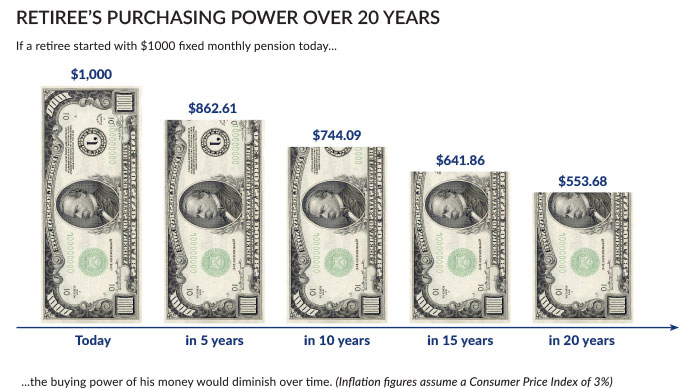

Your TCDRS benefit doesn’t automatically increase to keep up with inflation, so you should take inflation into consideration when figuring out your budget in the future.

Your TCDRS retirement benefit is a fixed benefit payment. That means the benefit amount will be the same every month for the rest of your life once you start receiving it. However, your expenses can change even if your lifestyle doesn’t. The cost of goods and services, such as groceries, gasoline and health care, goes up a little bit each year. Over time, your benefit purchases less and less due to inflation. A cost-of-living adjustment restores some of the purchasing power your benefit loses during your retirement years.

Your TCDRS benefit doesn’t automatically increase to keep up with inflation. Each employer has to consider the cost of their total benefits package when deciding whether to adopt one. COLAs don’t automatically renew each year, so even if you receive one, you should still take inflation into consideration when figuring out your budget in the future.

Strategies to Soften the Impact of Inflation

Save your Social Security for later: By waiting to apply for Social Security benefits, you increase the amount of your monthly payment.

Work in retirement: Working while receiving a retirement benefit payment is something many retirees do by choice because they enjoy working. It has the added benefit of increasing your income with wages that likely keep pace with inflation.

Talk to a financial planner or accountant: A financial professional may be able to help you look at your total retirement income and determine how best to use your resources. He or she could suggest an appropriate rate to draw down the savings in your other financial accounts to best deal with the effects of inflation.

Related Content

Get more information on why TCDRS is a model plan when it comes to retirement.

Taxes and Your Benefit Payment

Taxes don’t disappear when you retire. Having a plan for dealing with taxes during retirement can help you maintain your financial we...

Read more

Put Your Wishes in Writing

Many people think of terms like “power of attorney” and “estate planning” only when they near the end of their working life. But ther...

Read more

10.06.2022

How to Set Yourself Up for Financial Success, Even When the Economy is Spooky

Recession? Inflation? When scary financial news starts circulating, it might be tempting to hunker down when it comes to your retirem...

Read more