Updating your browser will give you an optimal website experience. Learn more about our supported browsers.

Group Term Life for Your Employees

You can provide the families of your employees with extra peace of mind by participating in Group Term Life, a program of group term life insurance administered by TCDRS.

For a grieving family, a Group Term Life benefit could help provide stability and dignity during a difficult time.

In addition, this completely optional program has advantages for you, as an employer:

-

More valuable benefits: The additional coverage can be a valuable tool for employee recruitment and retention.

-

Easy administration: Your payments go to the same place you send your retirement plan contributions — no extra effort required.

-

Trusted partners: You’ll get the same quality service and responsible management you have for your retirement plan.

Who is covered?

It’s up to you. If you choose to offer our life-insurance coverage, you can cover current employees in an “Active-Only” plan. Or you can extend coverage to retirees, in what’s called an “Active-Plus-Retirees” plan.

Sometimes a participating current employee becomes unable to work due to illness or injury, or passes away while absent under the Family Medical Leave Act. In such cases, coverage may be extended up to two years from the employee’s last TCDRS deposit.

How it works

Your active employees and/or retirees are automatically enrolled in the Group Term Life program when your organization chooses to participate. Upon the participant’s death, the following benefits apply:

-

Active-Only: Beneficiaries of current employees are eligible for a one-time payment equal to the current employee’s annual compensation.

-

Active-Plus-Retirees: This includes coverage for current employees as listed above, plus coverage for your retirees. Beneficiaries of retirees receive a one-time payment of $5,000.

What it costs

You, as an employer, pay a monthly premium (a percentage of payroll) to participate. Our coverage is very competitively priced. Rates are set annually, according to the demographic makeup of your workforce.

Tax considerations

The IRS considers a portion of any insurance premiums that you pay to cover an employee to be taxable income to the employee if the value of the insurance is over $50,000 — in this case, if the employee's compensation is more than $50,000.

Most beneficiary payments are not subject to federal income tax.

How to participate

You can take a look at how Group Term Life will fit into your total benefits package as you explore your plan options with the TCDRS Plan Customizer, available when you sign into your account.

If you have any questions about the Group Term Life program, please contact your Employer Services Representative at 800-651-3848.

Related Content

Get more information on why TCDRS is a model plan when it comes to retirement.

GASB 68 and Your Financial Reporting

Your GASB 68 Report provides you with the information you need to complete your audited financial statement. This report is available...

Read more

Lump-Sum Payments at Retirement

Some employers give their employees the option of taking a single payment of up to 100% of their TCDRS account balance when they reti...

Read more

07.25.2024

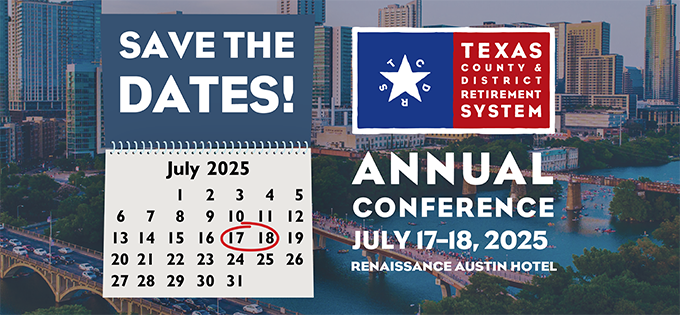

TCDRS Annual Conference

Save the dates! The 2025 TCDRS Annual Conference is July 17-18, 2025!

Read more