Updating your browser will give you an optimal website experience. Learn more about our supported browsers.

IRS 1099-Rs and retiree Benefit Statements are now available online. Sign into your account and go to the Documents card on your dashboard to view.

Paper copies will mail by Jan. 31. Please allow 10 business days to receive.

How 2021 Investment Performance Impacts Employer Rates & TCDRS Reserves

Thanks to the 2021 investment return, TCDRS and your plans are in a very strong position as we navigate the challenges and market volatility of 2022.

Investments play a huge role in funding benefits. Investment earnings fund an estimated 74 cents of every benefit dollar paid. TCDRS’ strong investment return in 2021 will impact your plan in two ways.

First, the positive returns will have a rate-reducing effect on your employer contribution rate. Other factors, such as demographic experience, also impact your rate, but we anticipate that more than 90% of our employers will receive a rate decrease in 2023.

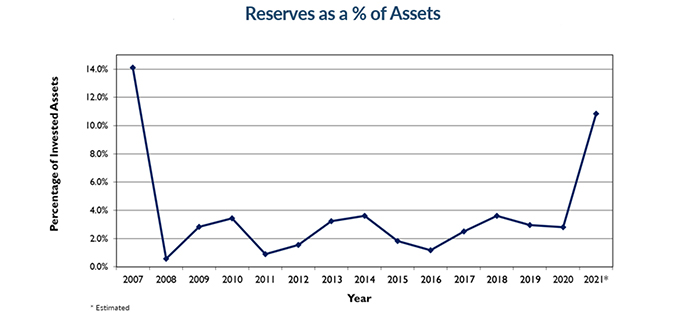

The second impact involves our reserves. Thanks to the gains this year, the TCDRS Board of Trustees has increased our reserves fund to nearly $5 billion — more than 11% of assets.

Maintaining a healthy reserves fund is important because it gives us an effective tool to offset future adverse experience and help keep employer rates more stable.

As a percentage of assets, the reserves are at their highest point since the Great Financial Crisis. At that time, we had more than 14% of assets set aside, and we used that fund to mitigate the losses that occurred in 2008, smoothing them over time to reduce the impact on employer rates.

TCDRS and your plans are in a very strong position as we navigate the challenges and market volatility of 2022.

Related Content

Get more information on why TCDRS is a model plan when it comes to retirement.

Managing Investment Risk

Risk is a factor in any investment, and we manage risk very closely. Fortunately, we have a great track record of meeting our perform...

Read more

Keeping Investment Costs Low

Our large fund size creates unique economies of scale that make our investment process more efficient. We never charge fees to our pa...

Read more

Responsible Guidance for Investments

The TCDRS Board of Trustees is responsible for overseeing the investment of TCDRS assets. They receive assistance from the investment...

Read more