Updating your browser will give you an optimal website experience. Learn more about our supported browsers.

IRS 1099-Rs and retiree Benefit Statements are now available online. Sign into your account and go to the Documents card on your dashboard to view.

Paper copies will mail by Jan. 31. Please allow 10 business days to receive.

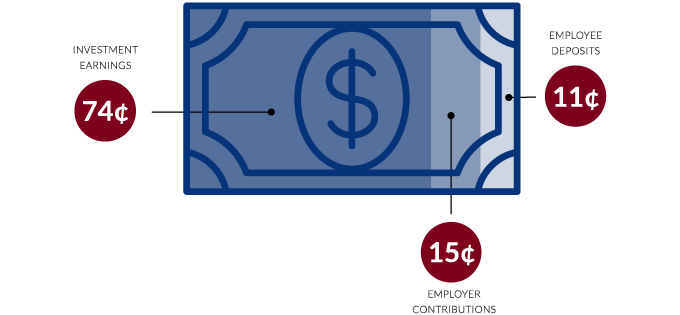

Investments fund most of the TCDRS benefit

Investments fund an estimated 74 cents of almost every benefit dollar paid.

A combination of three elements fund your plan: investment earnings, your employer contributions and your employees’ deposits.

We pool your employer and employee contributions and invest that money. Because you and your employees save for benefits in advance over your employees’ careers, you’ll get the maximum power of investment earnings over time.

At TCDRS, we are long-term investors. To put “long-term” in context, employees who retire from TCDRS work an average of 18 years and then may be retired for another 20-plus years, giving us an investment horizon of more than 30 years for just one retiree.

For more information, visit TCDRS.org/Investments.

Related Content

Get more information on why TCDRS is a model plan when it comes to retirement.

Managing Investment Risk

Risk is a factor in any investment, and we manage risk very closely. Fortunately, we have a great track record of meeting our perform...

Read more

Keeping Investment Costs Low

Our large fund size creates unique economies of scale that make our investment process more efficient. We never charge fees to our pa...

Read more

Responsible Guidance for Investments

The TCDRS Board of Trustees is responsible for overseeing the investment of TCDRS assets. They receive assistance from the investment...

Read more