Updating your browser will give you an optimal website experience. Learn more about our supported browsers.

Change Your Withholding Anytime at TCDRS.org

The payment you receive every month from TCDRS counts as income, and you have to take it into account when filing your income taxes. How much you owe depends on your total income, not just how much you get from TCDRS.

You don’t have to withhold taxes from your benefit payments, but if you choose not to (or don’t withhold enough), you may owe taxes.

You can start, stop or change your tax withholding in your online TCDRS account at any time by signing into TCDRS.org and clicking “Edit Withholding” at the bottom of your Account Summary card.

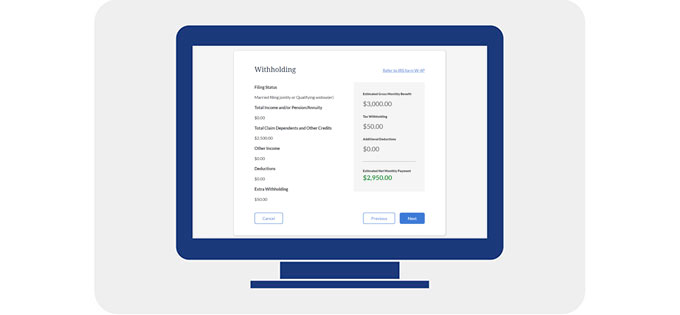

You can view your current selections and update your marital status, number of exemptions and any additional amount you want withheld. The deductions you select will depend on your personal circumstances. The more exemptions you claim, the less tax that’s withheld from your benefit.

You can also enter different amounts into the withholding calculator to see how they would affect your benefit payment right on the screen.

TCDRS cannot offer tax advice. For tax help, contact a tax expert. The IRS may offer free tax assistance in your area.

Related Content

Get more information on why TCDRS is a model plan when it comes to retirement.

Military Service Time

You may be able to receive service time for time served in the U.S. Military before you became a TCDRS member and count that service ...

Read more

Online Counseling for TCDRS Members

Online counseling is having a face-to-face counseling session with a TCDRS representative from the privacy of your home or office. A...

Read more

01.23.2024

Survivor Benefits for TCDRS Beneficiaries

We know that losing a loved one is difficult. TCDRS is there for you every step of the way to help make the benefits process go as sm...

Read more